Towards the middle of last year we were approached by Masters in Kent (one of our long term partners) who were tasked with building a mobile banking van for the co-operative bank.

The bank wanted to make sure their van would get and stay connected to the internet wherever they needed to deploy it and Masters wanted to make sure they could keep an eye on the battery monitoring system remotely (this was to be a fully electric vehicle).

We’ve done a lot of work with Masters in the past – particularly for Macmillan Cancer research who run a number of similar (although not electric) exhibition vans for pop up education and fund raising activities.

So although not a new thing for us, the added requirement with the co-op mobile bank was that they wanted to provide remote access to the onboard CCTV an battery management solution as well as make sure that their device based VPN was ultra relaible.

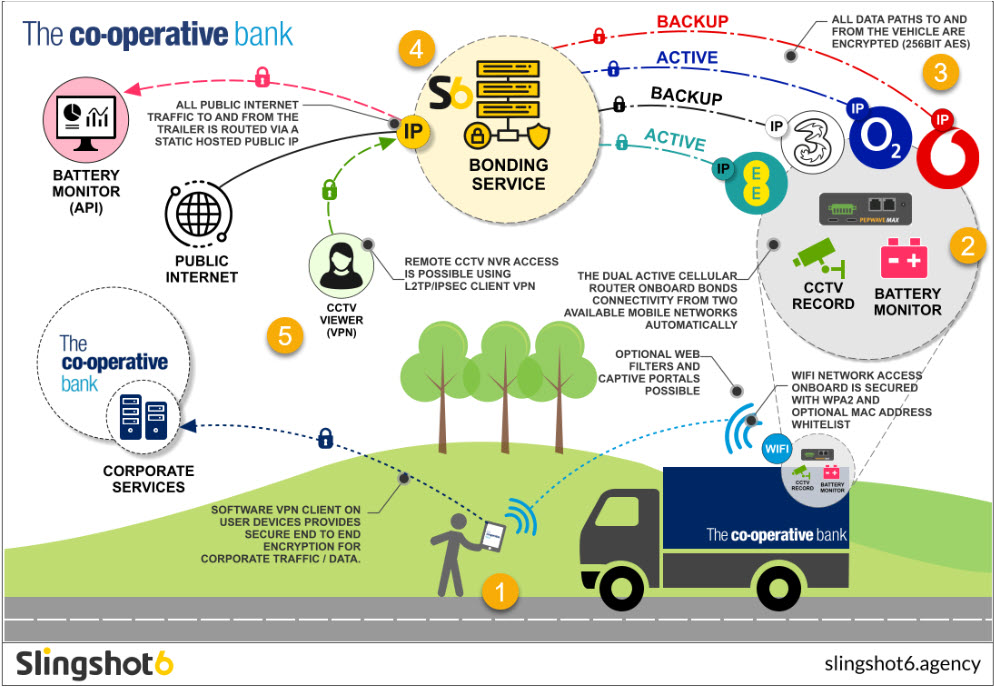

My solution design looked like this:

- Staff and customers onboard would use devices with the banks software VPN installed to connect back to the banks network.

- Connectivity was provided by a Pepwave MAX Transit Duo (CAT12).

- All UK mobile operator SIMS would be installed to guarantee connectivity. The van can also use public hotspots and wired internet connectivity where available and seamlessly bond and failover between all forms of connectivity.

- All active connections are bonded back to our hosted service to provide packet level resilience even when a WAN link fails. This also means that a single static IP is presented to the Co-operative datacentre firewall – no matter which SIM is in use, allowing for source IP firewall rules to be implemented.

- Remote access is provided via the static IP of the bonding service – not the dynamic changing IPs of the onboard connectivity.

Although COVID slowed down the deployment of the Pop Up bank last year, they have been very busy this year out and about supporting their customers in their communities in a way that was impossible to do so before. I look forward to seeing how mobile and pop up banking evolves for the co-operative bank in the future.